Nexys : Loan Origination Software – The best Solution for Your Lending origination workflow Process. Code Charley x nexys Collaboration

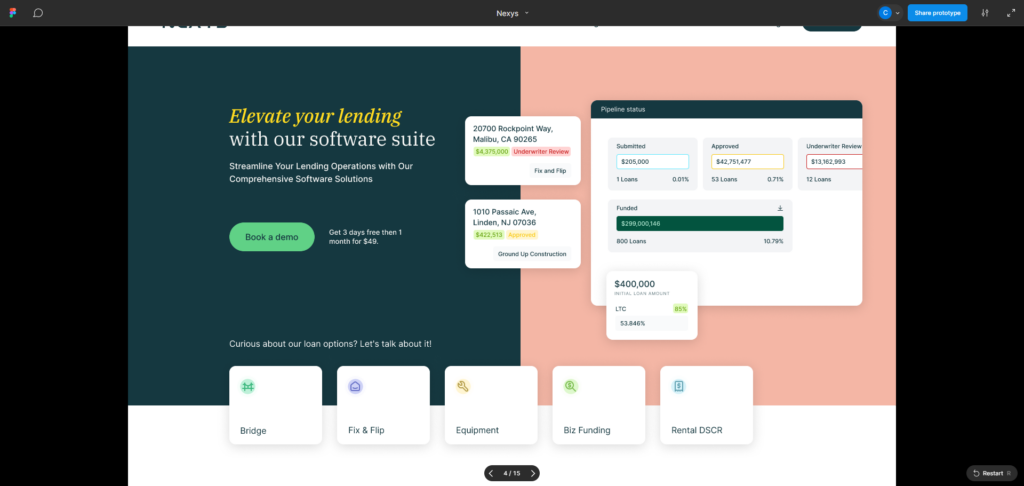

Transforming Digital Experiences for Nexys with CodeCharley’s Website Development Expertise. Nexys offers the ultimate solution for efficient, error-free loan origination applications to underwriting. Designed to enhance productivity and provide a seamless experience for private lenders, banks, mortgage professionals and borrowers. Nexys transforms how you manage loan applications. Partner with Nexys today for a smarter, more streamlined lending process workflow.

Company Name

Nexys, LLC

Nexys Address

8206 Louisiana Blvd NE a 3583, Albuquerque, NM 87113

Nexys Phone

(657) 330 – 8857

Nexys Email

nexysllc@gmail.com

Loan servicing and Loan origination Apps That Empower the Mortgage Industry

See the Figma Prototype

A sleek, modern design that aligns with Nexys’ brand identity while communicating professionalism and expertise in financial software.

Why Nexys Chose CodeCharley to build and lead their loan origination app

Nexys came to us with a clear goal: to build a powerful, scalable website that would demonstrate its leadership in the mortgage technology space. We worked closely with the Nexys team to create a custom web solution that accomplished the following:

We implemented cutting-edge apps that streamline user experiences, helping Nexys showcase its innovative mortgage technology solutions.

Data-Driven Web Design for Scalability

A Custom App for Enhanced User Experience

Measurement and Analytics Integration

AI Integration for Smarter Interactions

Document Management System Integration

Loan Servicing Tools Display

Loan Management Simplified

Optimized Cookies for Better Browsing

Hardware That Supports Innovation

The CodeCharley Web Development Process for Nexys’ apps and applications

When Nexys partnered with us, we followed our proven development process, ensuring success from concept to launch:

Web Development Services and applications We Provided for Nexys

We offered Nexys a range of specialized web development services designed to showcase their expertise in the mortgage tech industry. Our services include:

Kirk Ayzenberg

Nexys, LLC

Code charley

Website

Welcome to the Nexys Software Story: Website Development and SEO Marketing Success

At Code Charley, we take pride in delivering tailored solutions that help our clients achieve their business goals. Nexys, a leader in mortgage software solutions, partnered with us to revolutionize their online presence and marketing strategy. This page showcases the projects, strategies, and results that define our work with Nexys, covering both website development and marketing initiatives.

Website Development for Nexys

Nexys needed a robust, scalable, and modern online platform to showcase their innovative software solutions, including Mortgage CRM, Loan Origination Software, and Loan Servicing Software. Our development team worked closely with Nexys to understand their unique needs and created a user-friendly, high-performing website.

Key Features Implemented:

- Dynamic Navigation: We organized Nexys’ vast offerings into an intuitive navigation structure, allowing users to easily access products like EDSCR, their Loan Origination Software.

- Custom Resource Hub: Nexys required a scalable platform for publishing their 120-page resource library. We implemented an efficient content management system with accordion-style FAQs for seamless accessibility.

- Responsive Design: The website was designed with a mobile-first approach, ensuring excellent performance across devices, from desktops to smartphones.

- SEO-Optimized Architecture: We developed the site with an SEO-focused structure, creating silos for key product areas to boost search engine rankings.

Technologies Used:

- Frameworks: React.js for the front-end and Next.js for server-side rendering and dynamic routing.

- Hosting: Amazon Lightsail for a fast and reliable infrastructure.

- CMS: WordPress integration for blog and resource management.

The result is a fast, reliable, and visually stunning website that reflects Nexys’ expertise and leadership in the mortgage software industry.

Marketing Achievements for Nexys

A great website is just the beginning. To amplify Nexys’ visibility and reach, our marketing efforts included a combination of SEO, content marketing, and strategic partnership announcements.

SEO Excellence:

- Keyword Research: We identified and optimized for high-value keywords like “private lending software,” “loan origination software,” and “mortgage CRM solutions.”

- Content Creation: Blog posts, resource guides, and press releases drove organic traffic and engaged Nexys’ target audience. This included:

- An in-depth article on private lending software that positioned Nexys as an industry thought leader.

- A partnership announcement highlighting collaboration with Code Charley and Finresi, boosting credibility and brand trust.

- Performance Analysis: Regular audits and performance tracking ensured Nexys stayed ahead of competitors.

Content Strategy Success:

- Silo Pages: We created structured silo pages for core services, helping Nexys dominate SERPs (Search Engine Results Pages).

- Competitor Analysis: Our research informed design choices and keyword targeting, ensuring Nexys outperformed rivals in key areas.

Social and Partnership Engagement:

Leveraging announcements and partnerships, we crafted press releases and campaigns that resonated with Nexys’ audience. One example was the collaboration announcement with Code Charley, which highlighted the development process and results, attracting industry attention.

Results That Speak for Themselves

Our combined efforts in website development and marketing resulted in:

- Increased Organic Traffic: Nexys saw a substantial boost in website visitors, with a notable rise in conversion rates.

- Improved SERP Rankings: Key pages, including silos and resources, climbed to the top of search results.

- Enhanced Brand Recognition: Nexys is now firmly established as a leader in the mortgage software space.

Looking Ahead

Our partnership with Nexys continues to grow, as we explore new ways to expand their digital footprint. Whether it’s launching additional features, optimizing performance, or crafting engaging campaigns, Code Charley remains committed to Nexys’ success.

If you’re inspired by what we achieved with Nexys and want to elevate your own online presence, contact us today to get started!