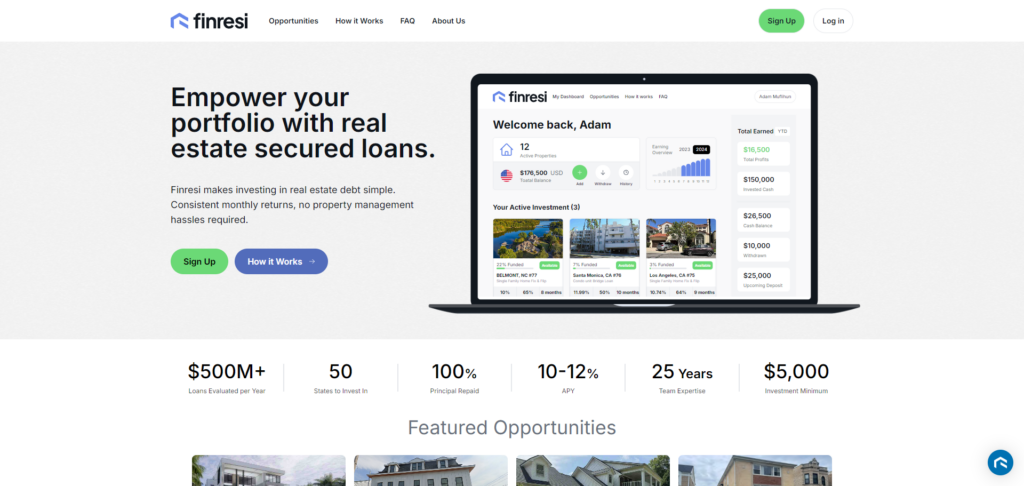

In today’s fast-paced digital era, mobile-friendly design is no longer a nice-to-have—it’s a must-have, especially for industries as dynamic and competitive as mortgage technology. Platforms like Finresi, a leader in mortgage software solutions, recognize that mobile responsiveness is essential to meeting the evolving needs of users. Whether for homebuyers researching mortgage options, lenders managing loan processes, or agents engaging with clients, the ability to access tools and features seamlessly on mobile devices is critical to success.

This article explores how mobile-friendly design not only enhances user experiences but also drives innovation, customer satisfaction, and overall success for mortgage software platforms like Finresi.

The Mobile Revolution in Mortgage Software

Why Mobile Matters

With over 60% of global internet traffic originating from mobile devices, businesses across industries are racing to adapt their services to meet the needs of mobile-first users. The mortgage industry is no exception.

Mortgage applicants and professionals alike increasingly rely on smartphones and tablets for critical tasks, from exploring loan options to managing documents and tracking application statuses. Platforms like Finresi understand this shift and have embedded mobile-friendly design into their core strategy to ensure their users can work efficiently anytime, anywhere.

Key Benefits of Mobile-Friendly Design for Mortgage Platforms

1. Enhanced User Experience

Mobile-friendly design ensures users can easily navigate and access features, no matter their device. For Finresi, this means intuitive interfaces, smooth scrolling, and responsive layouts that adjust seamlessly to screen sizes. Whether a user is filling out a mortgage application or reviewing loan documents, the experience is simple and frustration-free.

2. Increased Engagement and Retention

Users are more likely to engage with platforms that are accessible and easy to use on mobile devices. Mobile responsiveness encourages users to spend more time exploring features and tools, building trust and loyalty. For Finresi, this translates to higher customer satisfaction and retention rates.

3. Accessibility Anytime, Anywhere

Mobile-friendly mortgage software allows users to perform essential tasks on the go. Finresi’s platform ensures clients can check loan statuses, communicate with lenders, or upload necessary documents directly from their smartphones, enabling a level of convenience that drives long-term success.

4. Improved Search Visibility

Search engines like Google prioritize mobile-friendly websites in their rankings. By implementing responsive design, Finresi not only enhances the user experience but also improves its visibility in search engine results, attracting more organic traffic and potential clients.

5. Competitive Edge

In an industry where every advantage matters, mobile-friendly design positions Finresi as a forward-thinking leader. By catering to the preferences of modern users, they set themselves apart from competitors relying on outdated, desktop-only platforms.

How Finresi Embeds Mobile-Friendly Design into Its Mortgage Solutions

Dynamic and Responsive Interfaces

Finresi’s platform automatically adjusts to fit any screen size, providing a consistent and polished experience across all devices. This ensures that users, regardless of whether they are on a desktop, tablet, or smartphone, can interact with the platform effortlessly.

Optimized Performance

Mobile users expect fast load times and smooth functionality. Finresi’s platform is optimized for speed, ensuring that clients and professionals can access tools and resources without delays.

Secure Mobile Access

Given the sensitive nature of mortgage transactions, security is paramount. Finresi employs advanced encryption and authentication protocols to protect user data, making mobile access as safe as desktop use.

Intuitive Navigation

Simplified menus and clear call-to-action buttons ensure that users can easily locate the tools and information they need. This attention to detail enhances usability and minimizes the learning curve for new users.

Mobile Design as a Catalyst for Innovation

Empowering a Broader Audience

Mobile-friendly design doesn’t just cater to existing clients—it expands access to a broader audience. Younger, tech-savvy users, in particular, prefer platforms that offer mobile-first solutions. Finresi’s commitment to mobile responsiveness positions them to capture this growing demographic.

Supporting Industry Trends

As the mortgage industry embraces digital transformation, mobile design will continue to play a pivotal role. Tools such as virtual home tours, AI-driven loan calculators, and real-time updates on applications are becoming standard features. Finresi’s mobile platform is built to integrate these trends seamlessly, keeping them ahead of the curve.

The Role of Mobile-Friendly Design in Long-Term Success

Mobile-friendly design isn’t just about immediate convenience—it’s about sustainability and scalability. For Finresi, this means creating a platform that:

- Adapts to Technological Advances: As mobile devices evolve, Finresi’s responsive design ensures compatibility with future technologies.

- Builds Trust and Loyalty: Users who have a positive experience on mobile devices are more likely to return and recommend the platform to others.

- Drives Business Growth: Mobile optimization enhances visibility, engagement, and conversion rates, all of which contribute to Finresi’s long-term success.

Final Thoughts

For mortgage software platforms like Finresi, mobile-friendly design is no longer optional—it’s a critical component of delivering exceptional service and achieving sustained growth. By prioritizing responsiveness, security, and usability, Finresi sets the standard for innovation in the mortgage tech industry.

In collaboration with Code Charley, Finresi continues to lead the way, offering a platform that combines cutting-edge technology with user-centric design to meet the demands of today’s mobile-first world.

Contact us today to learn more about how Finresi and Code Charley are shaping the future of mobile-friendly mortgage solutions.