The Importance of Mobile Responsiveness in Mortgage Software for Nexys

Code Charley: Your Partner for Mobile-Optimized Software Solutions

Kirill Kirk Ayzenberg

Kirill Kirk Ayzenberg Projects with Code Charley Explore the innovative websites created by Kirk Ayzenberg in collaboration with Code Charley. As a skilled web developer, Kirk has contributed to a…

Nexys SEO Marketing

Nexys X Code Charley SEO Marketing Code charley Nexys X Code Charley SEO Success for Nexys: How Code Charley Delivered Results At Code Charley, we pride ourselves on delivering tailored…

Nexys

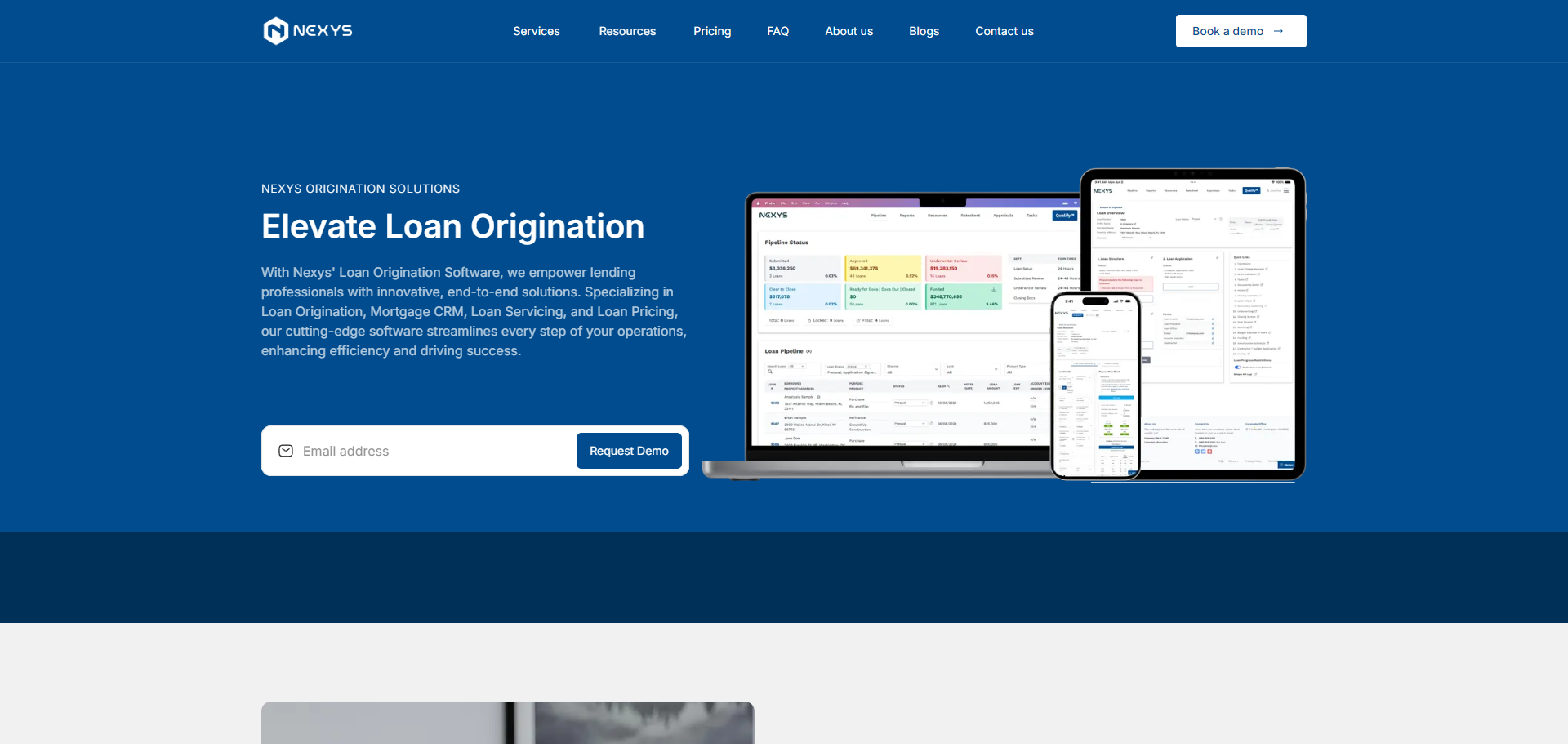

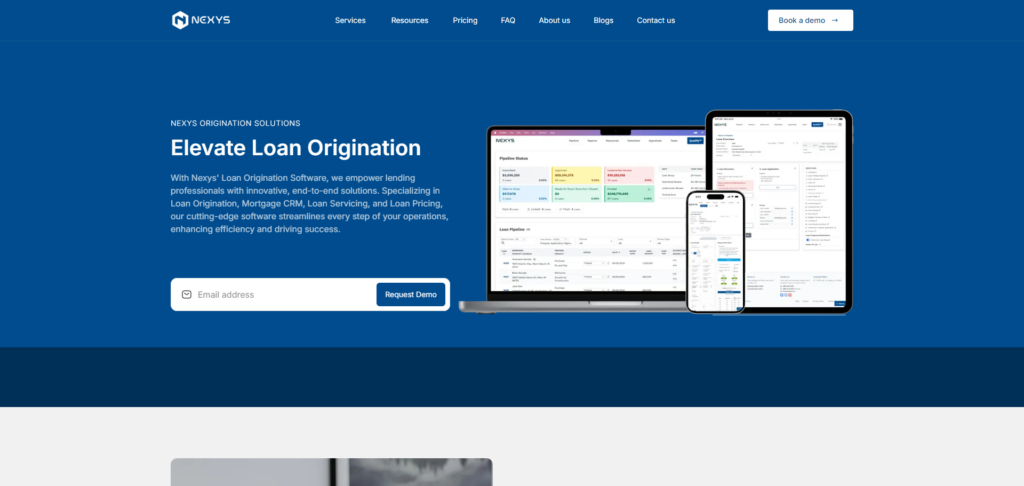

Nexys : Loan Origination Software – The best Solution for Your Lending origination workflow Process. Code Charley x nexys Collaboration Transforming Digital Experiences for Nexys with CodeCharley’s Website Development Expertise….

Code Charley Announces Strategic Partnership with Nexys to Revolutionize Digital Solutions for Mortgage Industry

Code Charley Announces Strategic Partnership with Nexys to Revolutionize Digital Solutions for Mortgage Industry Code Charley, a leading provider of professional web development and SEO solutions for the finance and…

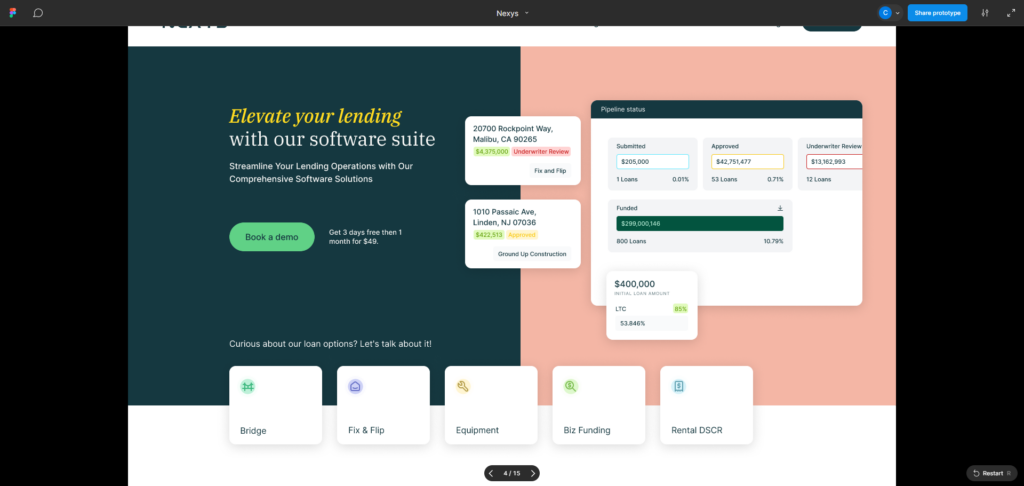

How Code Charley Brought Nexys’ Vision to Life with Cutting-Edge Web Development

How Code Charley Brought Nexys’ Vision to Life with Cutting-Edge Web Design and Development Nexys, a leader in the mortgage and financial software space, collaborated with Code Charley to elevate…

How Code Charley Conducted In-Depth Competitor Research to Give Nexys an Edge in the Mortgage Tech Space

Code Charley How Code Charley Conducted In-Depth Competitor Research to Give Nexys an Edge in the Mortgage Tech Space Understanding the Competitive Landscape In the highly competitive world of mortgage…

Code Charley’s Role in the Partnership

Code Charley will lead the design, development, and optimization of Nexys’ new web platform. The focus will be on delivering a user-friendly, SEO-optimized website that reflects Nexys’ leadership in the mortgage software space. The partnership will include: